Content

As we previously mentioned, you can find a variety of online accounting companies that aren’t limited to professional bookkeeping services. Virtual bookkeeping companies don’t just help you with your books – some even offer online CPA services. Depending on the plan you purchase, you can outsource all the accounting-related tasks of your business. There are many factors to consider, such as if they can handle the accounting tasks you want to outsource and if they offer the services you need at present and in the future. You will also want to take into account which accounting solution the bookkeeper uses and how you will communicate with them.

Every accounting service guesses at how at least some transactions might be categorized. Conscientious categorization will result in more accurate reports and income tax returns. It’s best used by small businesses that would make use of the lion’s share of its well-integrated features, and that need more powerful reporting options than https://www.bookstime.com/ many of its competitors offer. It also allows you to track fixed assets, which is an unusual tool in the category of small business accounting software. While the user experience is not exactly on the cutting edge, it’s still fairly easy to learn. Merritt Bookkeeping offers fixed pricing with no hidden fees that drive up your costs.

Pricing

If you already use QuickBooks, you’re in luck — Merritt Bookkeeping can import your existing data file. The company will get started on your books and provide you with monthly financial reports that are easy to understand. Wave Advisors offers personalized support through its in-house team of bookkeeping professionals. With Wave’s bookkeeping services, your books will be handled each month by trained financial professionals. Once you choose a bookkeeping service, be patient with the onboarding process. It may take some time to get a rhythm going with your virtual bookkeeping services.

What are the 4 important activities in bookkeeping?

- Data Entry. It seems like a tedious task, but it has become quite effortless with the introduction of modern accounting software.

- Managing Accounts Receivable and Payable.

- Financial Reporting.

- Bank Reconciliation.

- Conclusion.

Truly Small Accounting supports only transaction and contact management, invoices, and bills at this early stage, and it’s likely to stay small and uncomplicated. We liked it for its simplicity, its affordability, its usability, and its unusual approach to accounting when so many competitors are going the opposite direction and offering more features and services. FreshBooks is actually a full-featured, double-entry accounting system that happens to offer an exceptional user experience. It has won numerous PCMag Editors’ Choice awards for these reasons. Bookkeeper.com has very few online reviews, but the few that it does have are positive.

Working with our Live Bookkeepers

It may cost more if you have a full accounting firm at your disposal. The best online bookkeeping services will even provide some coaching or ideas if you need them. It’s easy to commingle business finances with your personal accounts, especially when you’re just starting out. QuickBooks Live is an excellent choice for business owners who’ve been handling their bookkeeping in QuickBooks Online, but now require more hands-on assistance. The prices above are applied if you are paying on a month-to-month basis; paying annually is cheaper. Outsourced bookkeeping services and a dedicated account representative is included in all plans.

Consider these possibilities when choosing a bookkeeping option for your business. The terms bookkeeper and accountant tend to be used interchangeably sometimes, so it is important to note their differences. Surendra is an astute Business Strategist, Cloud Evangelist and has Business Leadership experience in creating highly effective sales teams and leading strategic sales efforts with large global enterprises.

More time each day

We recommend FreshBooks especially for sole proprietors and companies with perhaps an employee or two—though it’s capable of handling more. Very small businesses could use it for basic money management, like sending invoices, monitoring financial accounts, accepting payments, and tracking income and expenses. More complex companies can add advanced tools that include projects and proposals, mileage and time tracking, and reports. Pricing for Wave’s bookkeeping services starts at $149/month when paying annually for bookkeeping and payroll support. Wave’s tax service add-on costs $1,500/year, and the accounting and payroll coaching plan costs $229/month when paid annually. Forget the books and focus on more important business tasks by signing up for online bookkeeping.

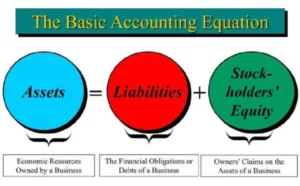

Sunrise is a free accounting service that provides insights on everything from cash flow to expenses. 1-800Accountant offers direct support from accountants and bookkeepers. These financial reports show a businesses bottom line and operating expenses, the balance of assets and liabilities as well as the cash flowing in and out of the business. At a basic level, bookkeepers manage transactions brought in through software, like an app. Bank feeds, that link the software with your business bank account, allow you to see each transaction in real-time. Like the laws and regulations, tax deadlines are quite strict as well.

How Much Should You Be Paying for Bookkeeping Each Month?

But if you don’t have a bookkeeper to keep tabs on these figures, you could be overspending on something that doesn’t give you much return-on-investment. Getting a small business bookkeeping service like bookkeeping services near me ours will give you a clearer and broader insight of your expenditures, as well as your profits. These financial reports can help you define a better budget and allocate your funds to the right things.

- The last three years must have been brutal for you if you own a small business.

- Let’s look into three different options your company could consider to fill this need…

- Bench’s plans are fit for any business that uses cash-basis bookkeeping, although custom pricing is available for accrual bookkeeping.

- However, you will find that there are a few virtual accounting companies that offer the same level of service yet the cost difference is enormous.

- Being a Merritt Bookkeeping customer also eliminates the need to pay a subscription fee for accounting software as Merritt will handle everything for you.

Ignite Spot’s online bookkeeping firm may be just what you need to reach your business goals of growth and debt reduction. Our team of experts will never look at your business as just a balance sheet with various debits and credits. Instead, we will assign you a certified bookkeeper who will work with you to perform all the day-to-day accounting work necessary for your business operation. The user-friendly online software used by Ignite Spot enables business owners to log in, send tasks to a bookkeeper, chat in real time to discuss issues, and review business reports. The best online bookkeeping services are affordable and easy to use, offer a wide range of bookkeeping solutions, and provide easy access to dedicated bookkeepers.

Expert BusinessAccounting and Bookkeeping

Bookkeeping is just as important to the success of your company as the company itself. The outsource bookkeeping for small businesses will supervise all such activities from beginning to end and will update management as necessary. It supports accurate reporting of data for compliance, managing the business, and making decisions on overall business expansion.

A certified public accountant (CPA) is an accountant that has passed the state exam and received a license. Online business accountants or bookkeepers handle your bookkeeping in the same way as in-house bookkeepers or accountants. The difference is that you are paying a monthly or yearly subscription for someone to do the work remotely, instead of hiring in-house employees. Ignite Spot is an outsourced accounting company for small businesses. The firm strives to coach business owners, instead of just doing their books.

Pilot users said that they appreciate the peace of mind that comes from knowing that their books are being handled accurately and in a timely manner. They also mentioned that the dashboard is user-friendly and that customer service is easily accessible when needed. Overall, the consensus of Bench users is that the service is easy to use and that the user interface is very intuitive. The ability to access Bench from anywhere when on-the-go is convenient for remote users, and its tax and consulting services are an added bonus. Danielle is a writer for the Finance division of Fit Small Business. She has owned a bookkeeping and payroll service that specializes in small business, for over twenty years.